On December 17th, 2024, following the election of Trump, Elon Musk was on top of the world.

Tesla had seen its shares rocket to an all-time high of $480 amid the belief that Musk’s close proximity to the new president would ensure Tesla’s continued growth as the world’s largest car company.

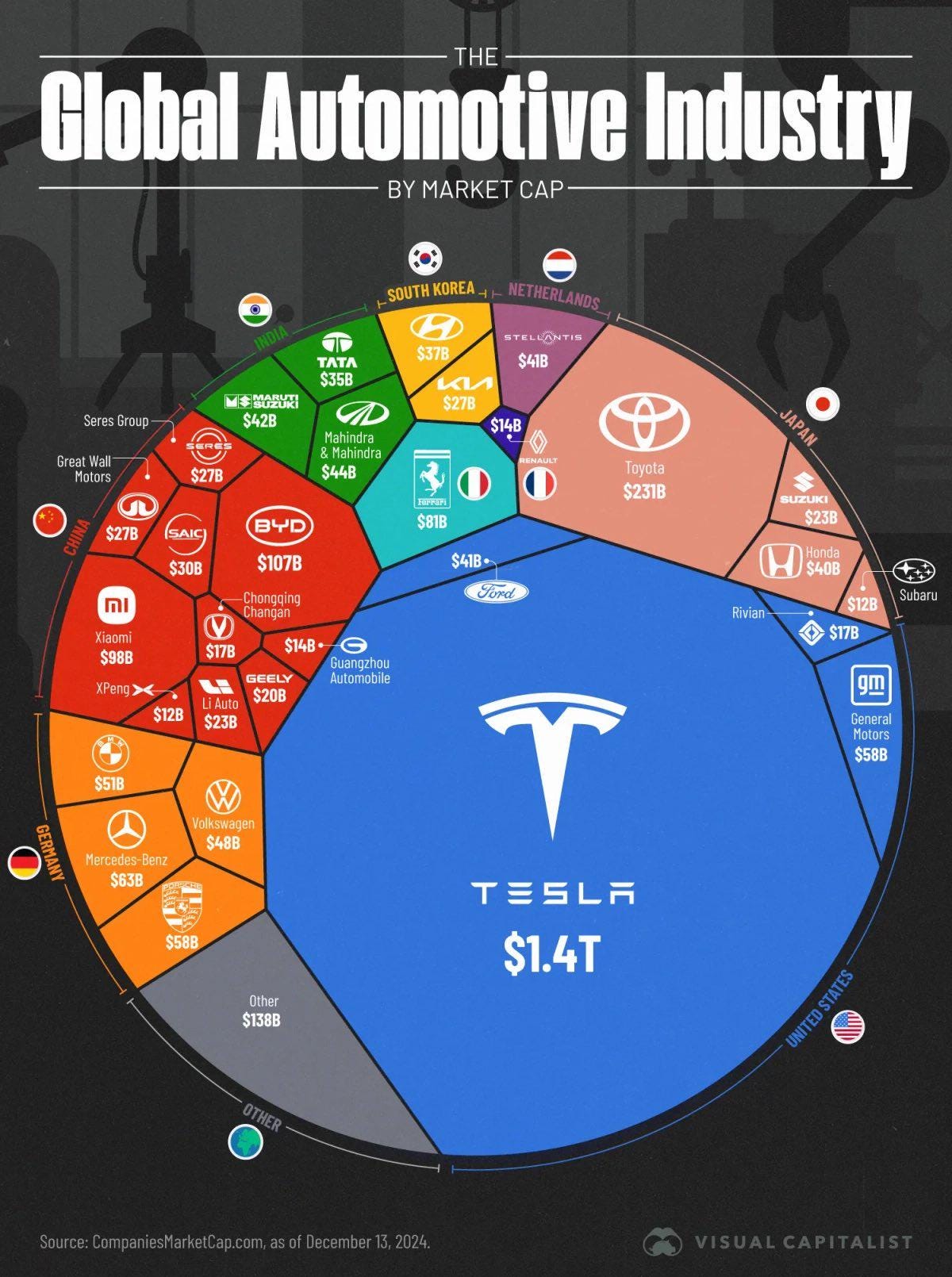

Just to give you an idea of their size at this point, Tesla was worth approximately 50% of the global automotive industry. Or to put it another way, it was more valuable than the next 29 car companies combined, with a total market cap of $1.688 trillion.

At this time, Musk’s wealth was reported to be between $440 and $486 billion, marking the highest net worth ever recorded by Bloomberg’s wealth index.

Then, in a move that defied all logic, Musk stood before the world press and decided to sieg heil.

As it turns out, if your company’s primary target audience is cashed-up progressive environmentalists, they don’t take too kindly to that sort of thing.

Since then, Tesla’s stock has crashed by over 50%, driven primarily by a complete collapse in sales globally, as the major EV markets of Europe and Australia see downturns of 70%+.

Many are now wondering if this is the end of the tech/car company we’ve all come to know.

But to understand how we got here, you have to go back to the beginning—back to the myth Musk built.

You see, ever since the beginning, Musk has wanted you to believe that Tesla is the future. A company built on world-changing technology, sustainable energy, and visionary leadership.

But here’s the truth—Tesla is not an innovator. It’s a hype machine, a stock market fantasy propped up by broken promises, financial manipulation, and exploitation. For years, Musk has cultivated a cult-like following, using Twitter storms, staged demos, and grandiose claims to keep the dream alive.

So, was this collapse inevitable? And just how long can Tesla keep the con alive?

Let’s dive in.

Hype Over Reality: How Tesla Sells a Dream It Can’t Deliver

For years, Tesla’s success has been driven not by its technology, but by the illusion of it. Musk has built his empire on promises—many of which never materialise, but always seem just a few years away.

Take Full Self-Driving (FSD), the long-promised feature that Musk has been dangling in front of investors and customers since 2016. Year after year, he’s insisted that full autonomy is just around the corner, promising self-driving taxis that would make car ownership obsolete. Customers have paid up to $15,000 for a feature that still doesn’t work as promised, drawing scrutiny from regulators.

The National Highway Traffic Safety Administration (NHTSA) has investigated Tesla’s misleading claims, and multiple fatal crashes have been linked to the company’s so-called Autopilot system.

Then there’s the Cybertruck debacle. First unveiled in 2019, Musk claimed it would be an indestructible, futuristic pickup that would reinvent the automobile industry. When its "unbreakable" windows shattered during the demo, the world got its first taste of the reality behind Tesla’s marketing.

After years of delays, the truck finally hit the market—but not without controversy. The promised $39,900 price tag mysteriously doubled, early buyers reported shoddy build quality, and the truck’s impractical design turned it from a symbol of innovation into a Silicon Valley joke.

And it’s not just the Cybertruck. The Tesla Semi, announced in 2017, arrived five years late. The next-gen Roadster, hyped as the fastest production car in history, is still missing in action. Musk once teased an affordable $25,000 Tesla, but quietly abandoned the idea when it became clear the company couldn’t pull it off.

For all of Musk’s grand promises, Tesla has always thrived on perception rather than results. And nowhere is that more evident than on Wall Street.

The Stock Market Ponzi Scheme

Tesla isn’t just an automaker—it’s a stock market manipulation machine, where investor hype is more valuable than actual cars.

In 2018, Musk made headlines with a tweet claiming he was taking Tesla private at $420 per share, insisting that funding had been secured. It was a blatant lie. The SEC fined him $20 million for securities fraud, but the damage had already been done. Tesla’s stock soared, Musk got richer, and his cult-like following continued to believe every word he said.

Tesla’s financial games didn’t stop there. In 2021, the company bought $1.5 billion in Bitcoin, announcing that it would accept the cryptocurrency as payment. Prices skyrocketed. Then, Tesla quietly sold most of its holdings, making a massive profit—before suddenly reversing course and announcing it would no longer accept Bitcoin due to “environmental concerns.” The cycle repeated: Musk pumped an asset, cashed out at the peak, and left investors scrambling to recover.

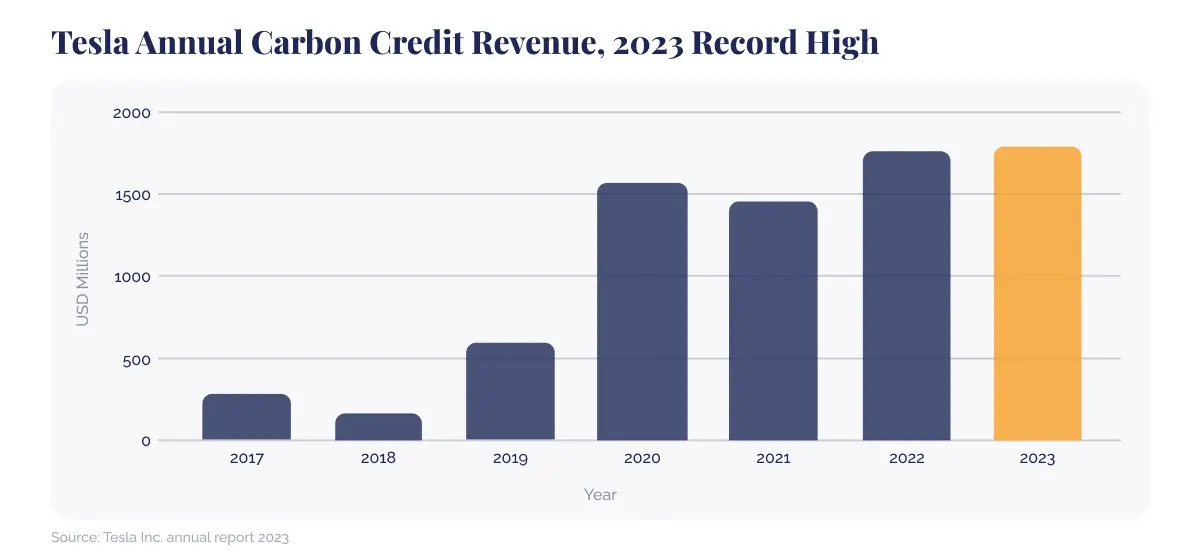

Beyond market manipulation, Tesla has found another way to stay afloat: government handouts. The company has made billions selling carbon credits to automakers that need them to comply with emissions laws. Instead of changing the world, Tesla has turned carbon credits into a revenue stream, allowing other companies to keep polluting while Musk cashes in.

At its core, Tesla isn’t just a car company or a tech company—it’s a financial construct designed to extract value wherever it can. And that mindset extends far beyond investors and government subsidies.

Tesla’s Brutal Workplace Culture

Behind the futuristic branding and flashy product launches, Tesla’s treatment of its workforce has been anything but revolutionary.

The company’s Fremont factory has been described as one of the most dangerous auto plants in the country, with workers subjected to grueling conditions, excessive overtime, and a pressure-cooker environment that has led to a disturbingly high rate of injuries. Reports have surfaced of employees collapsing on the factory floor from exhaustion, while Tesla’s management has been accused of underreporting injuries to make its safety record appear better than it is.

Racial discrimination is another mark on Tesla’s record. In 2021, a former black employee won a $137 million lawsuit after enduring years of racial abuse on the job. Swastikas and racial slurs were found scrawled on bathroom walls. Supervisors allegedly referred to Black workers as “slaves.” Instead of addressing the issue, Tesla tried to brush it under the rug—until the courts forced them to take responsibility.

And when workers have tried to stand up for themselves? Tesla has crushed unionisation efforts with illegal tactics, firing employees who pushed for better conditions and retaliating against whistleblowers. Musk himself has even gone so far as to threaten workers on Twitter, making it clear that anyone who unionised would lose their stock options. Federal labor officials have ruled against Tesla multiple times, but the company continues to fight any attempt at organising.

Musk loves to paint himself as a champion of the future. But inside Tesla, workers are expendable cogs in a machine built on hype. And the deception doesn’t stop there.

The Greenwashing Scam

Tesla’s biggest selling point? That it’s a green company saving the planet. The reality? It’s a PR stunt.

The company’s so-called commitment to sustainability falls apart the moment you look at its supply chain. Tesla’s batteries rely on cobalt mining, a dirty industry notorious for child labor and dangerous working conditions in the Democratic Republic of Congo. Lithium mining, another key component of Tesla’s supply chain, has caused water shortages and environmental devastation in South America. While Tesla promises to build a “sustainable future,” the reality is that its supply chain tells a different story.

Battery waste is another elephant in the room. Tesla has yet to develop a scalable recycling system, meaning that millions of electric car batteries could soon become a major environmental crisis. The company has claimed it recycles 100% of its batteries, but independent reports suggest otherwise.

Even Tesla’s much-hyped solar projects have been plagued by false promises. The Solar Roof, unveiled in 2016, was marketed as a game-changing innovation. Years later, installations remain rare and expensive, with many customers facing price hikes after signing contracts. What was once a symbol of Tesla’s commitment to clean energy now feels like another Musk publicity stunt that never fully materialised.

Tesla isn’t saving the planet. It’s profiting off the illusion of sustainability.

The House of Cards Is Collapsing

For years, Tesla has thrived on hype, stock manipulation, and fanboy devotion. But the cracks are starting to show.

The Cybertruck is a flop. The stock is crashing. Regulators are closing in. Musk’s erratic behavior is alienating customers. And Tesla’s biggest competitors—legacy automakers—are finally catching up in the EV race.

It’s a far cry from December 17th, 2024, when Tesla was riding high, its stock soaring on the belief that Musk’s proximity to power would secure its dominance. But illusions don’t last forever.

At some point, reality catches up to even the most elaborate deceptions. And when the Tesla scam finally collapses, it won’t be because of bad luck—it will be because the dream Musk sold was always destined to fall apart.

I'm not as optimistic, Tesla stock is still very high, losing 50% and still much higher than the year low. DOGE still has unchecked power, any agency which investigates Tesla or any of Musk's org might be next on DOGE chopping block. Next month, there might not be a Tranportation Department to investigate Tesla's safety record, there might not be SEC (currently being extremely weak) to investigate Musk's manipulation.

Great piece. As an African, I’d love to hear you elaborate on the Congo connection. It’s not spoken about enough, and honestly, I don’t know enough about Tesla’s direct involvement. Thanks.